Lightspeed Retail for chip cards

A simple and secure wwitch to EMV and Apple Pay

What is EMV?

As of October 1, 2015, any retailer who hasn’t upgraded their payment devices to support EMV technology will be held liable for fraudulent charges made in their store on EMV-compliant cards (also known as “chip cards”).

Learn more about how to prepare your business for the switch to EMV and protect yourself against credit card fraud. Get our free EMV and Mobile Payments guide.

Adopting EMV.

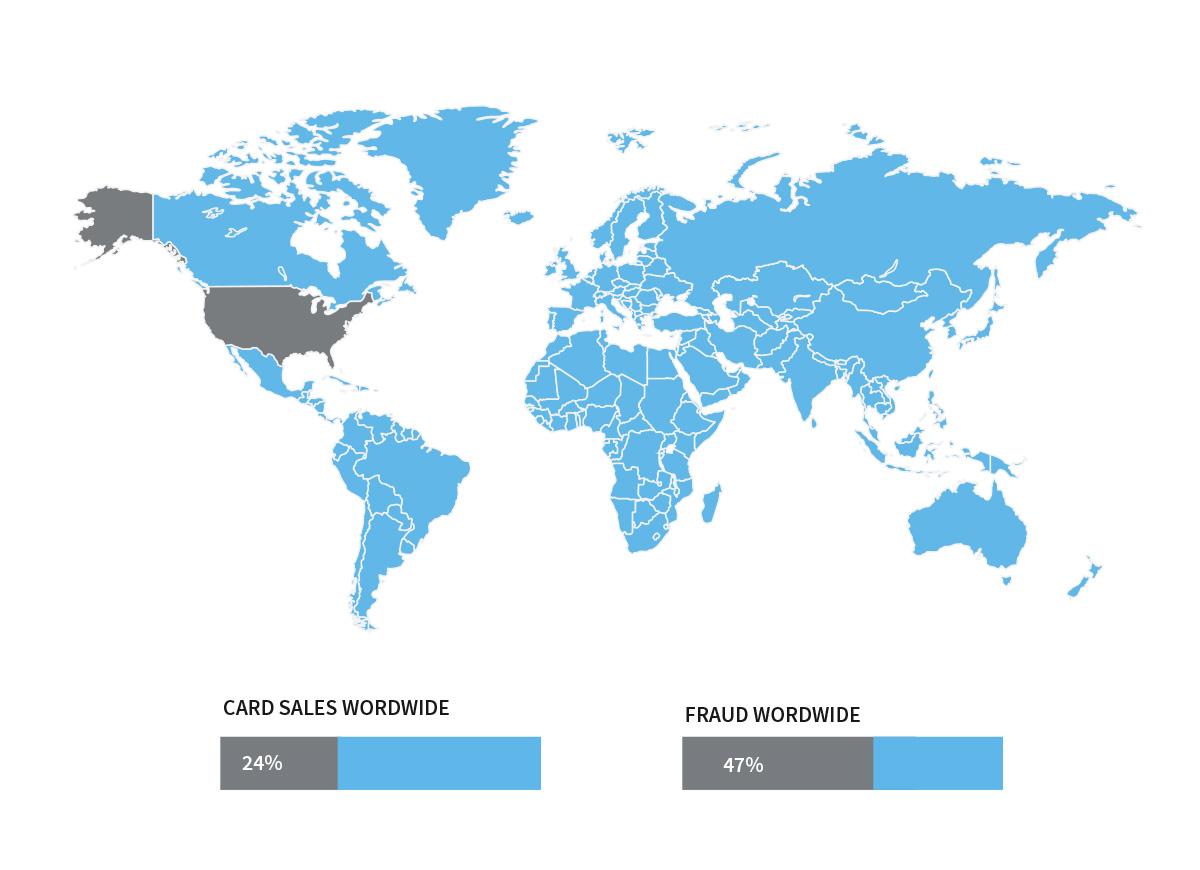

The U.S. has been plagued with the highest credit card fraud rate in the world for the last five years. Largely due to the lack of EMV regulations, 47% of all card fraud occurs in the U.S. (yet only 24% of global credit card transaction volume occurs here).

Traditional magnetic cards have static data that can be easily cloned and lead to fraudulent transactions. By switching to chip cards, you:

- Decrease your exposure to counterfeit cards: the microchip is virtually impossible to duplicate - it creates a unique impression each time it’s used

- Increase customer confidence with secure processing

- Reduce operational costs resulting from fraud

- Join the rest of the world’s retailers in the fight against payment card fraud

Make the switch.

In order to ensure that your store is protected, Lightspeed Retail supports both EMV and NFC-based payments, including Apple Pay, Samsung Pay, and Android Pay.

For a smooth transition, follow these next steps to ensure you’ll be ahead of the game and ready to accept EMV payments for the October 1, 2015 deadline.

We're here to help.

Change can be confusing. If you have any questions, please send an email or contact us at 1-866-932-1801.