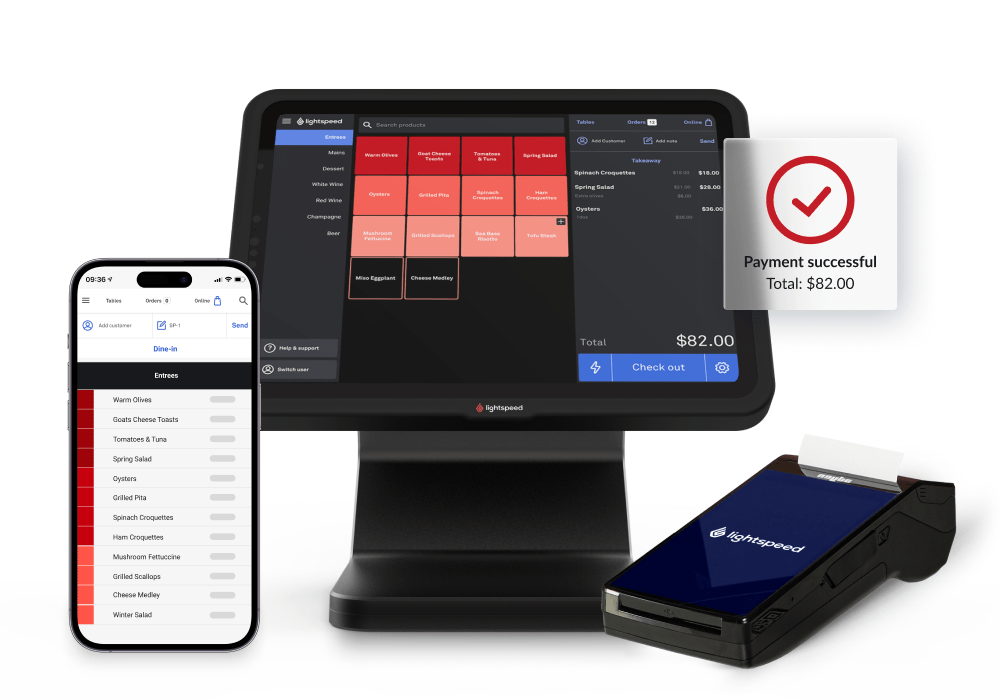

Unified POS and Payments platform

The complete restaurant payments solution, built into your POS

Lightspeed Payments makes it easier than ever to serve guests and get paid, from one unified platform.

Lightspeed powers leading businesses in over 100 countries.

$90.7B USD

Lightspeed’s customers processed $90.7 billion in GTV through Lightspeed’s platform in fiscal 2024

~165K

~165K locations around the world trust Lightspeed**

A payments solution you can trust

Our flexible, multilocation payment processor gives you the tools you need to scale your restaurant.

- Enjoy competitive rates—no setup costs or hidden fees

- Handle high volumes with no monthly transaction limit

- Rely on an expert team offering chargeback management and fraud assistance

- Uninterrupted service, even during Wi-Fi outages

- Eligible customers will receive one EFTPOS terminal for each POS register free of charge + no monthly terminal rental fees

Give guests a secure and seamless checkout

The experience your customers and employees have always wanted, with a processor that is fully embedded in your POS.

- Drive efficiency and accept credit, debit, and mobile payments from anywhere

- Display customer bills instantly, with no manual entry or keying errors

- Protect customers from fraud with built-in PCI compliance

- Enjoy in-built tipping capabilities

Premium security comes standard

Security is our top priority. Lightspeed Payments comes with premium security features built-in, so you'll have peace of mind from day one.

- Protect their data with PCI DSS-validated Level 1 Service compliance

- Secure your data with end-to-end encryption for all transactions, in-store and online

- Get 24/7 server security monitoring by our in-house team

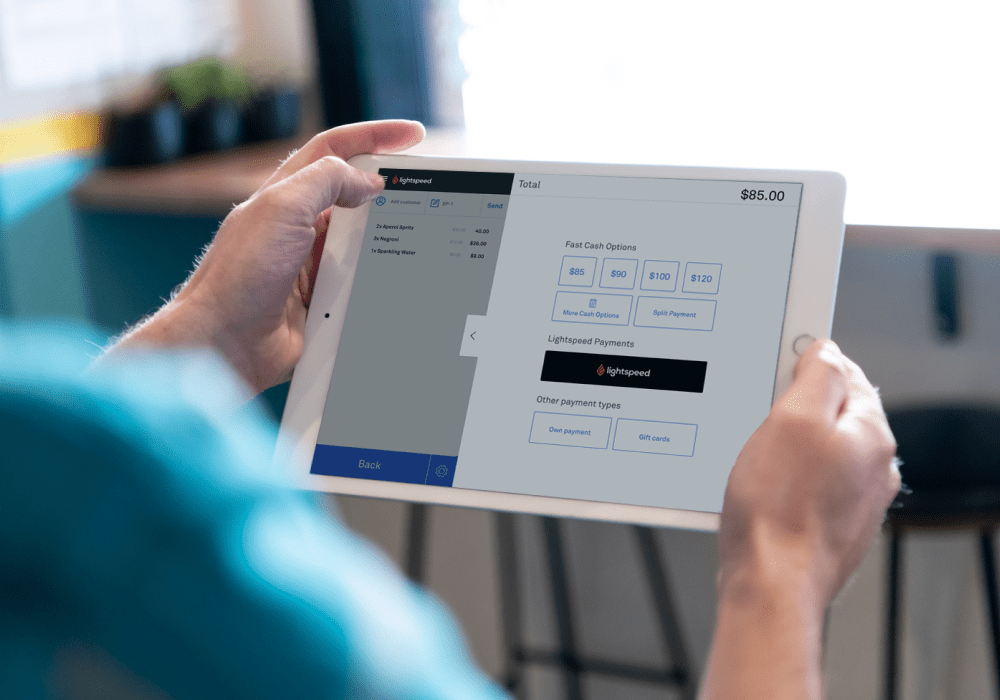

Ultimate flexibility with customisable surcharging

Lightspeed Payments empowers you to make the right decisions and choose what works best for you and your customers.

- Easily pass on card processing fees to customers with automatic surcharging

- Set a % amount for each card payment type. Based on the card presented, the terminal will automatically calculate the surcharge

- Control whether you pass on a partial amount or the full fee to cover all of your transaction costs

Considering the switch to Lightspeed?

Switching to Lightspeed is easy. From data migration to hardware and payments setup, our industry experts will support you each step of the way.

- Get fast 24/7 support

- One-on-one onboarding

- Dedicated Account Manager to answer every question