Wages, superannuation, penalty rates, and award categories can be challenging for business owners, especially when the goalposts change so frequently.

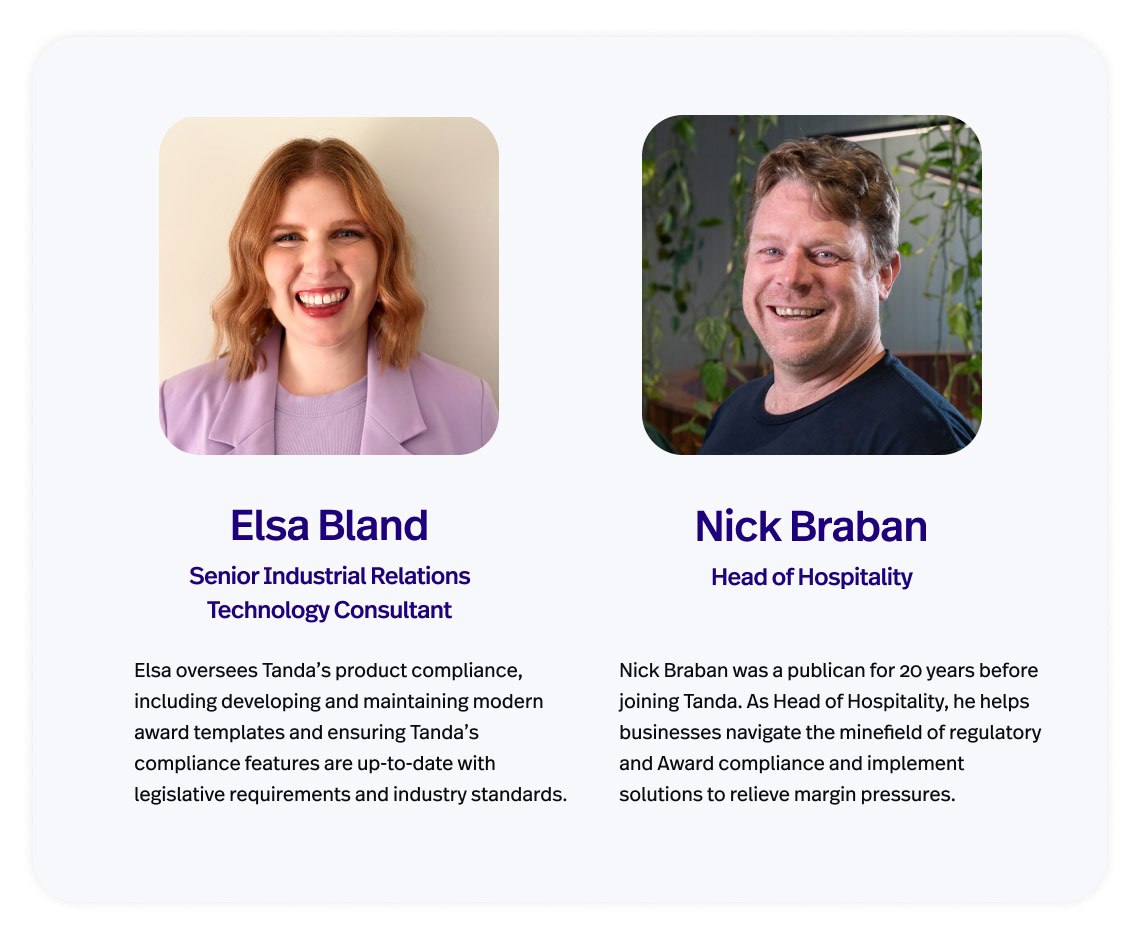

With this in mind, we sat down with Elsa Bland, Senior IR Technology Consultant and Nick Braban, Head of Hospitality and Partnerships at Tanda, one of Australia’s leading payroll platforms, to break down everything you need to know about hospitality wages and how to remain compliant.

Q: What are some best practice tips for wage compliance for hospitality operators?

A: Elsa Bland

The minimum wage increase takes effect on 1 July each year, and the increase applies to the first full pay period commencing on or after this date. This means that if you have a weekly pay period that commences on a Wednesday, the wage increase will take effect on the first Wednesday after 1 July each year.

While most payroll systems should automatically update the rates for you, it’s important to have a process in place to ensure the required rates are updated in time for your first pay period after the increases take effect.

This could include manually checking your rates within your system or contacting your payroll provider to ensure they are updated in accordance with government regulations.

We also recommend subscribing to updates from the Fair Work Commission on the modern award(s) applicable to your business.

Q: What are the most common and avoidable payroll mistakes that hospitality businesses make?

A: Elsa Bland

An important compliance piece to monitor is ensuring that junior employees who serve alcohol are paid as adults. This is a requirement under both the HIGA and RIA.

A process needs to be in place to ensure the higher rate is flagged with payroll, and managers need to be educated on the requirements. Most payroll systems, like Tanda, can assist with this compliance piece.

Q: What are your top tips for navigating the complexity of wage laws, such as calculating overtime and penalty rates?

A: Elsa Bland

My best recommendation is to use workforce management software to help navigate the complexity of the modern award system.

One of the best ways to manage compliance requirements is to have a system that can help establish strong rostering practices, automatically apply penalties, and identify potential overtime before the roster is published.

Q: Is misclassification of awards or categories a common issue for hospitality businesses? What are the penalties?

A: Elsa Bland

Misclassification of awards can be a common issue for hospitality businesses, and we’re seeing an increasing number of venues being spotlighted in the media for underpaying staff.

As part of the recent ‘closing loopholes’ amendments to the Fair Work Act 2009, intentionally underpaying employees will become a criminal offence from 1 January 2025.

The penalties include fines of up to $7.285 million for companies and $1.565 million for individuals, along with a potential prison sentence of 10 years.

It is important to note that this new offence is only relevant to intentional underpayments.

There are also state-based wage theft laws in Queensland and Victoria to be mindful of as well.

To prevent employee misclassification, it is important to regularly review employees’ duties and compare these duties against the classification structure as set out under your relevant modern award.

Q: What are the different salary structures that hospitality businesses practice?

A: Elsa Bland

Most hospitality businesses employ a combination of annualised salaries and full-time, part-time, and casual employees. Each employment type has its own set of compliance requirements and potential penalty and overtime conditions.

Annualised salaries

It is important to review the salary each year in line with minimum wage increases to ensure it remains at least 25% higher than the relevant minimum rate.

Full-time and part-time employees

You will want to ensure there are processes in place to roster full-time and part-time employees for their required minimum hours per day (minimum engagements) and their contracted hours each week.

When engaging a part-time employee under the HIGA or RIA, you will need to agree with the employee on their guaranteed hours. The guaranteed hours include the number of hours they will be rostered each roster cycle and the days on which these hours will be worked.

Casual employees

A key point regarding casual employees is to be aware of your causal conversion obligations.

As part of the ‘closing loopholes’ changes previously mentioned, the definition of casual employment will change, and a new pathway to casual conversion will come into effect on 26 August 2024.

You will also now need to issue the Casual Employment Information Statement (CEIS) to casual employees at the start of their employment, after 6 months of employment and then on the anniversary of employment each year.

Q: Is it standard practice to also raise the salary of experienced staff when entry-level wages increase?

A: Elsa Bland

Broadly speaking – the answer is probably yes. Senior staff on rates above award or salaries should have their remuneration assessed to see if it should also increase.

From a compliance standpoint, as 1 July approaches each year, it’s important to review your employees’ salaries and confirm that they cover the salaried employees for entitlements they would have received as hourly employees.

Tanda, for example, has a reporting tool called Wage Compare that compares a salaried employee against what they would have otherwise been paid as an hourly worker under a modern award.

This reporting tool is utilised by businesses to ensure that their salaried employee’s wages cover any penalties, overtime and allowances they would have otherwise been entitled to.

The Wage Comparison tool also has an outer limit reporting function that can be used to help manage annualised wage arrangements under the HIGA and the RIA.

Q: What are some best practice tips for hospitality businesses around superannuation compliance?

A: Elsa Bland

Employers must pay eligible employees their super guarantee a minimum of four times a year.

When calculating super payments, it is important to ensure that you can identify ordinary hours of work from overtime payments, as it’s not a requirement to pay super on any overtime. This is another area where workforce management systems can assist.

Also, ensure that you have reminders set up for when the quarterly super payments are due. This information can be found on the ATO website.

Q: Many hospitality businesses experience seasonal peaks and troughs, complicating staffing needs and wage budgets. What are your top tips for overcoming cost in wage spike during seasonal variability?

A: Nick Braban

Balancing labour costs during off-peak times while maintaining a ready workforce for busy periods is a major challenge for hospitality businesses. It can be a difficult balance to strike; taking these few steps can help alleviate any extra costs you might run into.

Cross-training team members

Cross-training your team allows those who would not normally perform certain roles to plug gaps, work more hours, and alleviate the strain on more senior team members–for instance, having a kitchen hand ready to assist FOH in peak times.

Preemptively hire new casuals

Preemptively hiring and training casuals to cover the busy season ensures you’ll have trained staff ready to go at the right time. It’s a tricky balance to not have too many people on the books too early. However, it’s probably worse to hire at the last moment and bear the pain of having to train people whilst in the weeds during back-to-back busy service days.

Prepare your team

Before your peak period starts, talk to your core team about the possibility of changing their working hours or usual work days.

For example, staff who work less than 38 hours a week may be offered more working hours for the next few weeks or months.

Re-align your salaried staff arrangements and rosters so they are available at key times, and consider changing compensation methods so you’re not paying excessive amounts of overtime. For example, consider offering your salaried staff extra hourly rates or time off in lieu for working different times and hours.

Q: Maintaining wage levels while managing reduced revenue can be particularly challenging during times of economic uncertainty. Are there any tips on how hospitality venues can lower their wage costs?

A: Nick Braban

One of the most effective strategies for maintaining profitability is having a well-planned roster that is guided by accurate revenue forecasts. By aligning your staffing levels with expected revenue, you can ensure that you are not overstaffed during slow periods or understaffed during busy times.

Plus, taking extra time earlier in the roster planning process allows you to make informed decisions that balance labour costs with service quality. Here are some tips for effective roster planning.

Q: What role can technology play in helping businesses lower wage costs and stay compliant?

A: Nick Braban

Modern point of sale (POS) platforms and rostering technology can allow managers to generate revenue forecasts based on what actually happened in previous weeks.

This means rosters can be built with confidence based on real data about when your venue is actually busy, not just “gut feelings” about how many people might need to be on at a certain time.

This, coupled with the warnings a good rostering system can provide about compliance when building an optimal roster, can help deliver better profitability and wage compliance.

Q: Are there specific tools or software that are well-suited for hospitality businesses?

A: Nick Braban

Your POS system is the heartbeat of your business and is the core tool from which to begin.

Having a cloud POS system like Lightspeed allows you to easily connect to other tools like Tanda.

When revenue flows “live” from Lightspeed into tools like Tanda, you can generate revenue forecasts based on what actually happened in previous weeks. This empowers you to know, at any moment of the day and week, how you are tracking in line with your targets.

Using reporting dashboards within these platforms also allows you to see live wage results against real revenue, meaning you can make confident changes along the way to stay on track.

Q: How are hospitality venues currently using AI to improve rostering, manage wages, predict peak periods, and optimise staff scheduling based on performance metrics?

A: Nick Braban

AI and machine learning tools in products like Tanda allow revenue and wage forecasting to be generated automatically from a larger number of data points rather than a simple averaging approach.

Things like weather, seasonality and major events can start to influence both the revenue forecast and the recommended rostering pattern that the systems provide to better nudge managers towards good rostering decisions.

Q: What other opportunities can AI offer in this space for businesses and tech companies?

A: Nick Braban

It’s exciting to consider how AI tools can assist throughout the hospitality business flow. AI is already assisting with stocktaking, data entry, accounts receivable, pricing menus, and all the other “boring” parts of managing stock and cost of goods.

The burden on business operators to remain compliant and on top of ever-changing government regulations has grown immeasurably over the last decade. People would likely prefer to be front-of-house talking about food and wine with customers rather than spending large portions of their week pushing paper.

AI can possibly move the needle back–automating a lot of this administrative burden and getting hospitality operators back doing what they love. No one decided to get into the hospo trade to sit behind a desk managing paper for the government – we want to be out front engaging with people or on the pans cooking up a storm!

Lightspeed and Tanda

We’d like to thank Elsa and Nick for taking the time to chat with us about this very important issue of wages in the hospitality industry.

Tanda integrates directly with Lightspeed to further streamline employee wages, onboard employees, create rosters and track their attendance. It helps more than 5,000 businesses with staff ranging from 10 to 100,000 members.

Editor’s note: The content in this post is intended for informational purposes only and should not be considered legal, financial, or tax advice. We recommend consulting with a qualified legal or accounting professional for personalised guidance. Where available, we have included primary sources to support our information. We strive to ensure accuracy; however, we cannot be held liable for any actions taken based on this content. Please note that Lightspeed does not commit to updating or verifying any new changes to the information in this blog post after its publication.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.