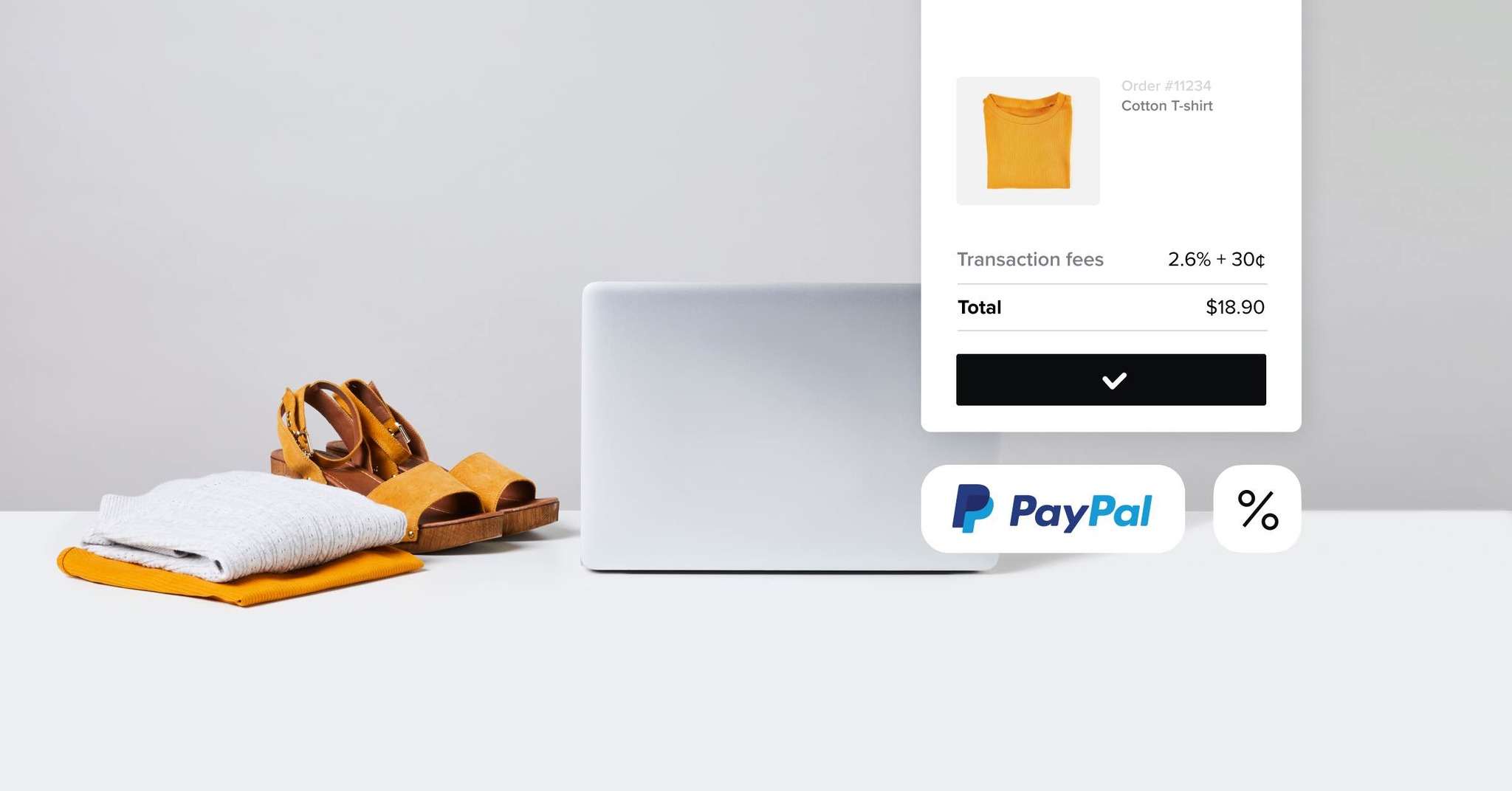

PayPal is a popular payment gateway that enables merchants to accept payments from customers online, as well as send and receive money from other PayPal users. However, PayPal charges fees for its services, and it’s essential to understand how these fees work to ensure you’re not losing out on profits.

PayPal charges fees based on the type of transaction, currency, and the country where the transaction takes place. For Australian retailers, PayPal charges a fixed fee plus a percentage of the transaction amount. There are several fees retailers need to be aware of, especially if you’re operating multiple stores or eCommerce stores.

- Commercial transaction rates

- Fixed fees

- Percentage-based fees

- Additional fees

- Receiving Recurring Payments on eCommerce Site

- Staying up to date on PayPal’s fees

POS Security: 6 Smart Ways to Protect Retailer and Customer Data

Discover the ways you can protect your business from hackers and fraudsters.

Commercial transaction rates

When a merchant makes commercial transactions, either by receiving payments for products or through QR codes through PayPal, there are rates attached to those transactions.

- Commercial transactions incurs a rate of 2.60% plus a fixed fee

- QR Code transactions of $10.01 AUD and above incur a rate of 0.90% plus a fixed fee

- QR code transactions of $10.00 AUD and below incur a rate of 1.40% plus a fixed fee

Fixed fees

For domestic transactions within Australia, PayPal charges a fixed fee of 30 cents per transaction. For example, if a customer purchases an item from your online store for $50, PayPal will deduct a fee of 30 cents from the transaction amount, and you’ll receive $49.70.

For international transactions, PayPal charges a fixed fee of 30 cents plus an additional fee based on the currency used for the transaction.

For instance, if a customer from the United States buys an item from your eCommerce store for $50 USD, PayPal will deduct a fee of 30 cents plus an additional fee of 4.4% of the transaction amount (or $2.20 USD), and you’ll receive $46.50 USD.

PayPal uses the mid-market exchange rate to convert currencies, which is typically more favourable than other currency conversion options.

Barcode generator

Tired of manually managing your inventory? Create unlimited unique barcodes for your inventory today with our free barcode generator tool. It's easy to use and compatible with all scanners.

Percentage-based fees

Apart from fixed fees, PayPal charges a percentage-based fee on the transaction amount. The percentage fee varies based on the total amount of sales processed through PayPal.

The higher the sales volume, the lower the percentage fee. Here are five percentage fees Australian retailers need to be aware of:

- For sales up to $1,500 AUD per month, the percentage fee is 2.6% plus the fixed fee of 30 cents per transaction.

- For sales between $1,500 and $6,000 AUD per month, the percentage fee is 2.2% plus the fixed fee of 30 cents per transaction.

- For sales between $6,000 and $15,000 AUD per month, the percentage fee is 1.9% plus the fixed fee of 30 cents per transaction.

- For sales between $15,000 and $50,000 AUD per month, the percentage fee is 1.6% plus the fixed fee of 30 cents per transaction.

- For sales over $50,000 AUD per month, you can contact PayPal to negotiate a custom rate.

It’s important to note that these fees apply to eligible transactions only. Some transactions may be ineligible for seller protection, such as payments received through PayPal.me or personal payments sent through PayPal.

Additional fees

PayPal offers additional services that come with their fees. For example, if you want to accept payments through PayPal Credit, you’ll be charged an additional fee of 1.9% plus a fixed fee of 30 cents per transaction. If you want to accept payments through PayPal, the fee is 1.95% for all transactions.

Receiving recurring payments on an eCommerce site

The same fees apply for eCommerce purchases as they do for in-store purchases. However, with consumer behaviour trending towards eCommerce, it’s imperative that merchants keep this in mind to ensure they know where fees are being charged.

According to The New Shopper Ecosystem report produced by Klarna and Inside Retail, 74% of Australians do half of their shopping online. The survey revealed that online shopping behaviours are increasing

- 33% have more confidence in purchasing online

- 37% have bought new types of items online

- 61% of Australians are shopping more often with their mobile phones

Keep up to date on PayPal’s fees

Overall, PayPal’s fees are relatively competitive compared to other payment processors. However, it’s essential to understand the fees to ensure you’re pricing your products and services correctly and not losing out on profits.

It’s important to stay up to date on any charges you may get from using PayPal. Make sure to stay up to date with PayPal’s policy updates to ensure you’re up to date on the current rates and fees.

White Paper: Retail Insights & Shopper Sentiment for 2024

Comprehensive report, a survey of 750+ Australian adults, that reveals customers’ shopping preferences and habits, and shares actionable insights for retailers in 2024.

Bring your vision to life

Are you an ambitious retailer who wants intuitive tech to help scale your business? Lightspeed Retail is the easy-to-use platform loved by over 150,000 stores. Our unified system automates tasks, streamlines processes and improves visibility across channels, so you can focus on what matters. To learn how you can leverage Lightspeed, watch a demo.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.